Table of Contents

The "bullish flag" pattern is a popular chart formation used by traders to signal a continuation of an existing uptrend. This pattern resembles a flag on a pole and typically appears during a brief pause or consolidation in a strong upward market trend.

Here's how it's structured and how traders typically interpret and use it:

Structure

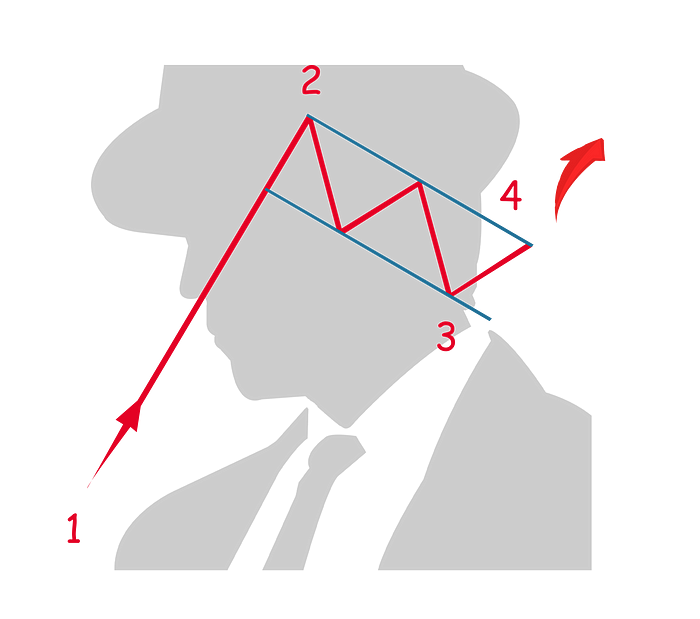

1. The Pole: The pole is formed by the initial sharp increase in the price of the asset, which represents a strong move upward. This rise should be steep and on significant volume, indicating strong buying interest.

2. The Flag: After the rapid increase, the market enters a consolidation phase. During this phase, the prices typically retreat slightly in a narrow, downward-sloping price channel or a small rectangular area that tilts down. This formation looks like a flag at the top of the pole. The flag portion is usually much shorter and less steep compared to the pole. This pattern can form over a few days to weeks.

Significance

The bullish flag pattern is considered a continuation pattern, meaning it signals that the previous upward trend is likely to continue after the pattern completes. The consolidation (flag) phase is viewed as a period during which buyers are catching their breath before pushing the price higher again.

Trading Considerations

- Entry Point: Traders often look for an entry point when the price breaks above the upper boundary of the flag. This breakout should ideally occur on higher volume to confirm the pattern's validity and the likely continuation of the bull trend.

- Target Price: The target price after a breakout can be estimated by measuring the length of the pole and projecting that distance upward from the point of the breakout at the top of the flag.

- Stop Loss: To manage risk, a stop-loss is commonly placed below the lowest point within the flag or at a predetermined percentage below the breakout level.

- Volume: Watching the volume is crucial; it should be high during the pole's formation and lower during the consolidation in the flag. An increase in volume on the breakout lends further credence to the move.

The bullish flag pattern is highly regarded for its reliability and the clear signals it provides, making it a favorite among traders who follow technical analysis. However, like all trading strategies, it is wise to use it in conjunction with other indicators and analysis methods to improve accuracy and manage risks effectively.